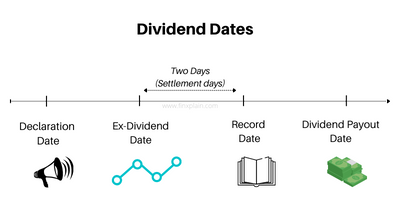

Here's quick guide for different dates you would read during Dividend announcement made by the Company and what does it signify -

Dividend Declaration Date : Date on which the dividend is announced by the company

This is the first trigger event, when company announces the dividend. This announcement includes details like dividend amount, total amount of dividend distribution and the record date (will explain this next).

Record Date (Cut-off date) : This is the date by when your name must be on the company's record books as a shareholder to be eligible to receive the dividend

On the dividend declaration day, together with quantum of dividend, the company also announces the Record Date. The record date is the date to simply put date on which final list of shareholder eligible for dividend would freeze. So if you want to be eligible for dividend, your name should be present on the company’s list of shareholders i.e. record book, by this date.

Shareholders whose name are not registered until this date on the company’s record book will not receive the dividend.

Ex-Dividend Date : The date before which you must own the stock

The Ex-dividend date is usually two days before the record date. Reason for 2 days is due to the stock settlement time of 2 days followed in India. When you buy a stock, it takes two days (settlement time) before it gets reflected in your demat account. If you buy the stock on or after the Ex-dividend date, stock will not be reflected in your account within Record date and hence you won't get the dividend, instead, the previous owner of stock will get the dividend.

Dividend Payment Date : This is the date when dividend is disbursed to the shareholders

This is the date set by the company on which the dividends are disbursed to the shareholders.

Only those shareholders who bought the stock before the Ex-dividend date and got their name in record book of the company would be entitled to get this dividend.

So if you are planning to get benefit of Dividend, Ex-dividend date is crucial and you need to make sure, that you buy the stock before stock starts trading as Ex-Dividend in secondary market.

Want to learn about how Dividend yield is calculated? Read here.

0 Comments

Your comment is appreciated. I look forward for your views / feedback / suggestions.