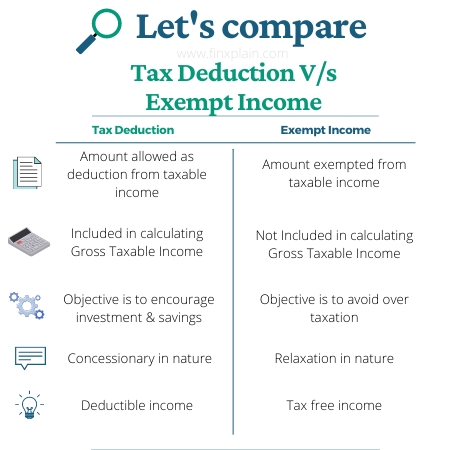

Income tax terminology can get very confusing at times and one of the most confused term is distinction of 'Tax deduction' and 'Exemption'. The lack of understanding leads to lot of people failing to report in the Exempt income in the Income Tax Return (ITR) filing.

Understanding difference between 'Tax deduction' and 'Exempt income'

Tax deduction refers to the amount of money that is allowed as deduction from your total taxable income. The final amount after 'tax deduction' from total income is referred as ‘taxable income’. Concept of 'Tax deductions' is to motivate individuals to save and invest, also allowing some necessary expenses. Examples of 'Tax deduction' are amount deposited in PPF, NPS, donation made to charities (section 80G), Medical insurance, etc.

'Exempt income' on other hand means income that are excluded for arriving at taxable income. Exempt income are of two types - fully exempt (like Agricultural income, PPF interest, etc) and partially exempt (income subject to certain limit, like House Rent Allowance, Leave Travel Allowance, etc). Remember Exemptions are always from the specific income head and not from the gross total income. For e.g., Exemptions allowed under salary head cannot be claimed from any other income head.

To summarize, Exempt income is tax free from the point it is earned, while tax deduction are the part of income which is excluded basis certain tax provision and excluded from computing taxable income.

Why disclosure of Exempt Income is important?

Disclosure of Exempt Income is often ignored by individuals while filing income tax return, thinking it does not get taxed anyway - what assesse forgets is, this non-reporting can put them in risky situation when the future enquiry about the source of income is raised by Income Tax officer. In absence of disclosure under Exempt Income, you cannot pin-point source and open the assessment for further enquiry.

Section 10 of Income tax Act deals with all the incomes which are exempt from computing income taxes. Some examples of Exempt Income:

- Interest credited to Provident Fund - Fully exempt (Statutory PF, PPF). In case of Recognized PF, only to the extent interest does not exceed 9.5% (Learn more about PPF here)

- Dividend income from domestic company (amount not exceeding Rs. 10 lakh)

- Gift or Voucher or Coupon on ceremonial occasions or otherwise provided to the employee - (a) Gifts in cash or convertible into money (like gift cheque) are fully taxable (b) Gift in kind up to Rs.5,000 in aggregate per annum would be exempt, beyond which it would be taxable.

- Any income generated from agriculture and related activities including rent from land/farmhouse used for agricultural purpose, further processing of the agricultural product, income from seeds or saplings, etc. [Section 10(1)]

- Share of income received from the family income, being a part of a Hindu Undivided Family [Section 10(2)]

- Any amount received as a part of a life insurance plan including policy bonus [Section 10(10D)]

- Any withdrawals from the provident fund (for salaried employees) [Section 10(11)(12)]

- Amount received as compensation from the government, in case of disasters [Section 10(10BC)]

- Income generated from tax-free securities [Section 10(15)]

- National Pension System - Any payment from the National Pension System Trust to an assesse on closure of his account or on his opting out of the pension scheme referred to in section 80CCD, to the extent it does not exceed 60% of the total amount payable to him at the time of such closure or his opting out of the scheme.

Disclosure Of Exempted Income For Salary Allowances in ITR

Disclosure of this type of exempted income is required to be made under "Schedule S - Details of Income from Salary" when filing tax returns

- House Rent Allowance (HRA)

- Leave Travel Allowance (LTA)

- Encashment of Leave

- Pension

- Gratuity

- Voluntary Retirement Scheme

- Perquisites

Disclosure Of Exempted Income For Non-Salary Allowances in ITR

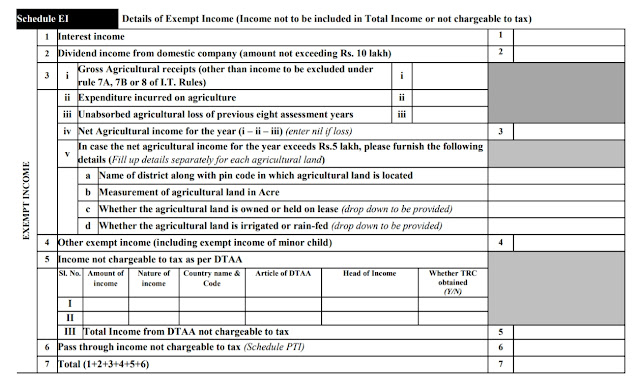

The Income Tax Act also specifies specific types of non-salary income that are also exempt from tax. These incomes include dividends, agricultural income, interest on funds, capital gains etc. Disclosure of these types of income is required to be made by the taxpayer under "Schedule EI - Details of Exempt Income" when filing tax returns

Screenshot of Exempt Income input required in ITR2:

Long-term Capital Gain tax exemption

It's important to note, Budget 2018 proposed to remove Section 10 (38) of the Income Tax Act, 1961. As per this section, the long-term capital gains (LTCG) arising on sale of equity shares or units of an equity-oriented mutual fund on which Securities Transaction Tax (STT) is paid was exempt from taxation. This section was initially introduced through the Finance Act, 2004, with effect from AY 2005-06, based on the Kelkar Committee report to attract investments from Foreign Institutional Investors (FII).

The Budget 2018 introduced Section 112A by withdrawing Section 10(38). It proposed to impose tax on the LTCG of the following: Shares, Equity-oriented funds or Business trusts.

The LTCG tax is applicable at a rate of 10% on gains over and above Rs 1 lakh a year, and there is no benefit of indexation. The provisions of this section will apply from the financial year (FY) 2018-19, i.e. AY 2019-20.

Note: Article is meant for basic understanding and general guidance. Check with your tax consultant before filing taxes. Article is written on 1st Jan 2021 basis the then prevailing tax rules.

0 Comments

Your comment is appreciated. I look forward for your views / feedback / suggestions.