The Public Provident Fund is a sound savings cum tax saving instrument in India. Started in 1968 by the National Saving Institute of the Ministry of Finance. It is a long term saving instruments with stable return and zero capital risk, bundled with tax savings feature giving extra edge.

Should you open a PPF account?

This is ideal for an individual who are risk averse. Having said that, I personally feel, everyone should have this as a part of their investment strategy. This can be used to allocate debt component of the portfolio. Obviously with the limits, which we will see further below.

Who can open a PPF account?

Any individual Indian citizen residing in India can open PPF account. Parent can open account in the name of minor children. While opening account for minor, one of the parent’s PAN is required. Remember, tax savings will continue to be at Rs 1,50,000 for both account put together i.e. of parent and minor child.

You cannot open Join account, it's for individual.

Non-residents are not permitted to operate PPF account but can continue the existing account till it matures. No further extension of 5 years is available, once it matures.

Hindu Undivided Family as known as HUF is no longer permitted to open PPF account (notification no GSR 291(E) dated May 13, 2005). In order to claim deduction u/s 80C, HUF can contribute to the PPF account of its members and claim tax deduction

Where you can open PPF account?

You can open PPF account in either Post Office or Bank.

Banks accepting the PPF accounts are - designated branches of State Bank of India and its subsidiaries, ICICI bank, Axis bank, HDFC bank and few others.

Amount of deposit

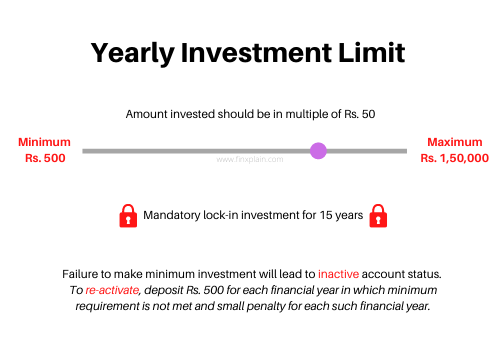

Minimum deposit in each financial year should be of Rs 500 and maximum can be Rs 1,50,000Deposits can be made in multiple of Rs 50 and any number of times in a financial year. Earlier, a maximum of 12 deposits were only permitted in a financial year.

Interest Rate

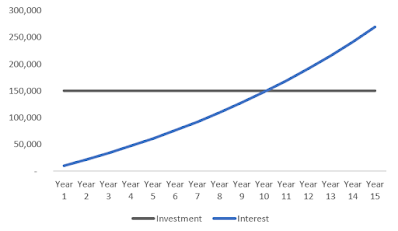

Interest rate is fixed by the Finance Ministry every quarter. The current PPF interest rate is 7.1%. Though the interest is calculated every month, it gets credited to your account on 31st March every year. Also, the PPF interest is calculated on the minimum balance between the fifth and the last day of the month.

For example: You have a balance of Rs 1 lakh in your PPF account on 30th April. Now, let's imagine you deposit ₹10,000 in your PPF account on 3rd May and ₹5,000 on 30th May. Now, the interest on your fund for the month of May will be calculated on Rs 1.10 lakh and not Rs 1.15 lakh

Taxation

Investments up to Rs. 1.5 lakh is eligible for tax deductions under Section 80C

PPF falls under EEE Category, i.e. Exempt – Exempt – Exempt, which basically means

The amount you deposit is tax exempt [under Section 80 C]The interest on deposit is tax exempt [under Section 10(15)]Final maturity amount is also tax exempt

Note:

- Always disclose Interest earned in PPF account as part of Exempt income in your tax returns

- All the balance that accumulates over time is exempted from wealth tax computation

Inactive PPF account

For any reason, if you do not deposit minimum amount of Rs. 500 in any financial year, account gets inactive. However, to re-activate, you can pay the minimum amount of Rs. 500 for each financial year you have not deposited together with nominal penalty of Rs. 50 for each such financial year and get your account re-activated.

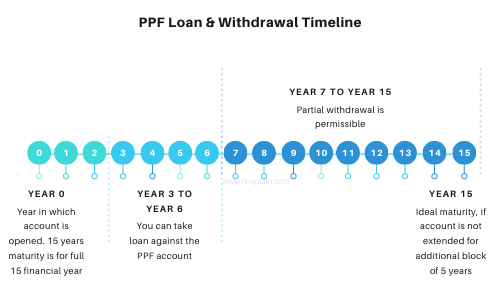

The minimum lock-in period of a Public Provident Fund is 15 complete financial years from the end of the year in which the account was opened . On maturity, you can withdraw your entire corpus. If you wish to continue for a longer period, you can continue to do so (with or without making additional contributions) by applying for the extensions in 5 year blocks. There is no limit on how many time you can extend after the initial lock-in period of 15 years.

One can prematurely close the account after 5 years from the opening of account under specific circumstances

- Treatment of life threatening disease of the account holder, his spouse or dependent children or parents, on production of supporting documents and medical reports confirming such disease from treating medical authority

- Higher education of the account holder, or dependent children on production of documents and fee bills in confirmation of admission in a recognised institute of higher education in India or abroad

- On change in residency status of the account holder on production of copy of passport and visa or income tax return

Premature closure of PPF accounts will lead to 1% lower interest than the rate at which interest is credited to the account

Loan against PPF account

An advantage of PPF accounts is that you can take a personal loan against the balance in your PPF account provided your PPF investment is not due for withdrawal. This loan can be availed between the third and the sixth financial year of opening the account. The loan amount is limited to 25% of the balance at the end of the second financial year prior to the year in which you applied for the loan. You are not required to pledge a collateral when taking a loan against your PPF account.

Under the new rules, the rates at which the account holder can borrow from his account has been reduced to 1% above the prevailing PPF interest rate, from 2% earlier. In case of death of the account holder, the nominee or legal heir shall be liable to pay interest on the loan availed by the account holder but not repaid before his death. Such amount of due interest shall be adjusted at the time of final closure of the account.

- Deposit any amount between Rs. 500/- (minimum) and Rs. 1,50,000/- (maximum) in a financial year

- Current Rate of Interest Payable (Currently as on Oct 20, it is 7.1%)

- Loan facility is available from 3rd financial year up to 6th financial year

- One withdrawal is permissible every year from 7th financial year

- Account matures on completion of 15 complete financial years from the end of the year in which the account was opened

- After maturity, account can be extended for any number of a block of 5 years with further deposits

- Account can be retained indefinitely without further deposits after maturity with the prevailing rate of interest

- Deposit in PPF account is qualified for deduction under Sec 80C of Income Tax Act

- Interest earned in PPF account is completely exempted from Income Tax under Sec 10(15) of Income tax Act

- The amount in the PPF account is not subject to attachment under any order or decree of a court of law

Frequently Asked Questions

Q: Can you open 2 PPF account?

A: No, only one PPF account can be opened by an individual

Q: Can I close my PPF account early?

A: Under specific circumstances, you can withdraw after completion of 5 years. So for example, if you open an account in Jan 2020, you can begin making partial withdrawal starting FY 2025-26

Q: Can I extend PPF account for 4 years after maturity?

A: No, extensions can be done only in block of 5 years

Q: I deposited amount in my child’s name, can I claim benefit?

A: Yes, if your PAN is used to open the minor’s account, you can claim the benefit of deposit. However, overall deposit cannot exceed Rs. 1,50,000 and so the benefit.

Q: Can I transfer my PPF account?

A: Yes, you can transfer your PPF account from one branch to another

To conclude, it’s one of the most wonderful investment option for risk averse investor.

Resource: Historical PPF interest rates

| Period | Rate of Interest |

| 1968-69 | 4.80% |

| 1969-70 | 4.80% |

| 1970-71 | 5.00% |

| 1971-72 | 5.00% |

| 1972-73 | 5.00% |

| 1973-74 | 5.30% |

| 1 Apr 1974 to 31 July 1974 | 5.80% |

| 1 Aug 1974 to 31 Mar 1975 | 7.00% |

| 1975-76 | 7.00% |

| 1976-77 | 7.00% |

| 1977-78 | 7.50% |

| 1978-79 | 7.50% |

| 1979-80 | 7.50% |

| 1980-81 | 8.00% |

| 1981-82 | 8.50% |

| 1982-83 | 8.50% |

| 1983-84 | 9.00% |

| 1984-85 | 9.50% |

| 1985-86 | 10.00% |

| 1 Apr 1986 to 31 Mar 1999 | 12.00% |

| 1 Apr 1999 to 14 Jan 2000 | 12.00% |

| 15 Jan 2000 to 28 Feb 2001 | 11.00% |

| 1 Mar 2001 to 28 Feb 2002 | 9.50% |

| 1 Mar 2002 to 28 Feb 2003 | 9.00% |

| 1 Mar 2003 to 30 Nov 2011 | 8.00% |

| 1 Dec 2011 to 31 Mar 2012 | 8.60% |

| 1 Apr 2012 to 31 Mar 2013 | 8.80% |

| 1 Apr 2013 to 31 Mar 2016 | 8.70% |

| 1 Apr 2016 to 30 Sep 2016 | 8.10% |

| 1 Oct 2016 to 31 Mar 2017 | 8.00% |

| 1 Apr 2017 to 30 Jun 2017 | 7.90% |

| 1 Jul 2017 to 31 Dec 2017 | 7.80% |

| 1 Jan 2018 to 31 Sep 2018 | 7.60% |

| 1 Oct 2018 to 30 Jun 2019 | 8.00% |

| 1 Jul 2019 to 31 Mar 2020 | 7.90% |

| 1 Apr 2020 to 31 Mar 2021 | 7.10% |

| 1 Apr 2021 to 30 Sep 2021 | 7.10% |

0 Comments

Your comment is appreciated. I look forward for your views / feedback / suggestions.